Deadline for Income Tax Return in 2021 Whether it is working or doing business for tax safety the most important thing that cannot be ignored is tax declaration and tax payment From March 1st the income tax of 2020 income must be reported. Handles the income tax file of the respective company.

New Company Return Form Form C For Year Of Assessment 2019 Released By The Inland Revenue Board Of Malaysia Irbm Baker Tilly Malaysia

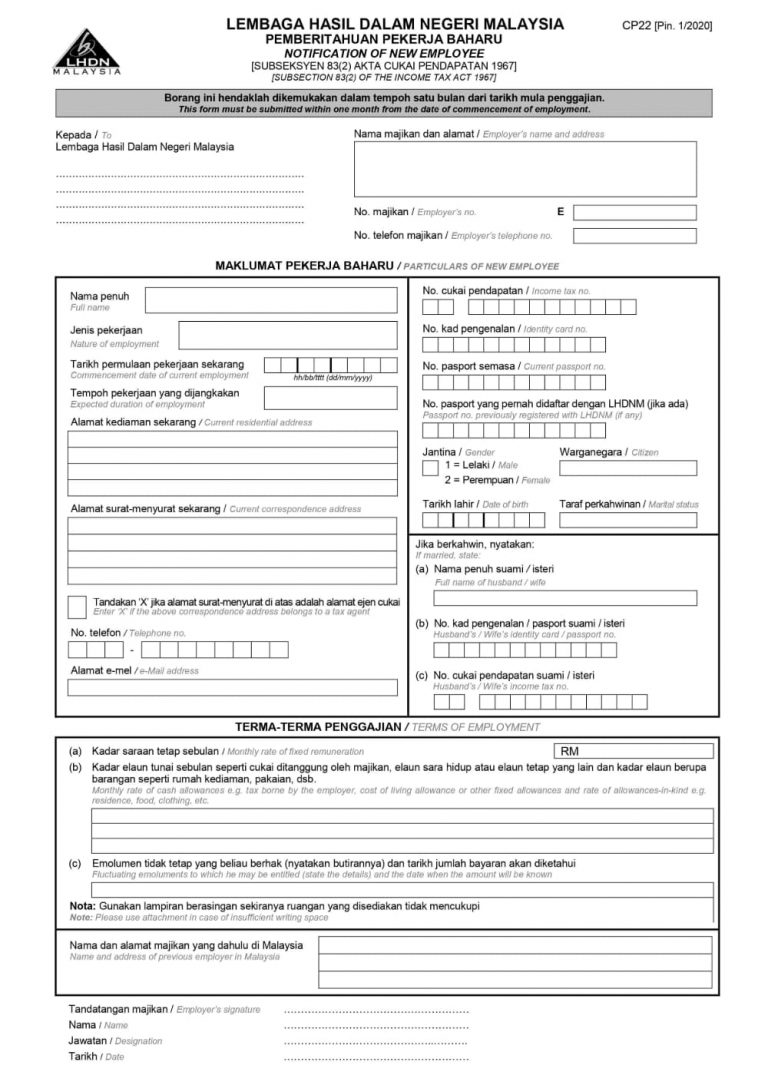

E number is employer.

. 21 Salinan kad pengenalan bagi warganegara Malaysia pemastautin tetap atau pasport bagi bukan warganegara Malaysia. An income tax computation pursuant to subsection 77A3 of ITA 1967. The issuance of Tax Clearance Letter is subject to the complete documents and information received with the consideration of these criteria.

C number and E number. Income tax return for companies. Majikan dan Kata Laluan.

Muat Turun Borang - Syarikat. A statement under section 77A of the Income Tax Act 1967 ITA 1967. Step 4 key in your company E number Nombor Majikan 请输入E号码.

22 Sijil pendaftaran perniagaan bagi warganegara Malaysia yang menjalankan perniagaan. An income tax computation pursuant to subsection 77A3 of ITA 1967. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National. Form C refers to income tax return for companies. C mengemukakan maklumat yang betul dalam borang nyata perenggan 77A3b dan perenggan 1201h.

The sales tax exemption under Schedule C Sales Tax Persons Exempted from Payment of Tax Order 2018. Bagi majikan yang tidak membuat penghantaran data praisi majikan perlu menghantar data CP8D bersama-sama Borang E mengikut format yang ditetapkan atau melalui e-Filing. Payment of Balance of Tax under Section 103A2 and Debt Due to Government under Section 1086.

Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. 23 Pasport dan sijil pendaftaran perniagaan bagi. Muat Turun Borang.

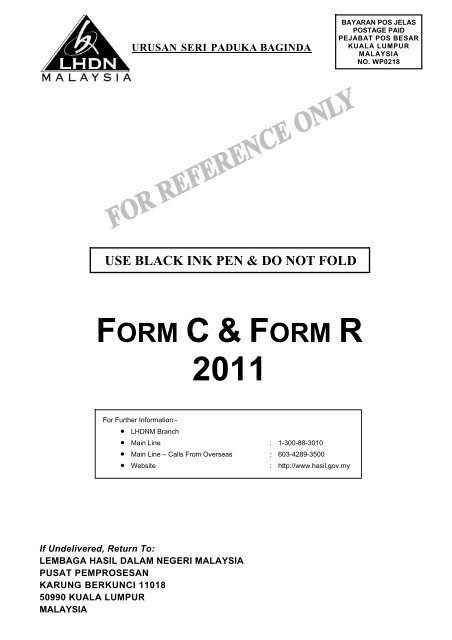

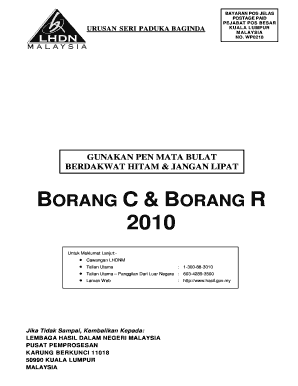

Late reporting will be fined. Premium Federal Tax Software. GUIDE NOTES FOR FORM C AND FORM R FOR YEAR OF ASSESSMENT 2012 Director General of Inland Revenue Lembaga Hasil Dalam Negeri Malaysia Date.

GUIDE NOTES FOR FORM C AND FORM R FOR YEAR OF ASSESSMENT 2012 Director General of Inland Revenue Lembaga Hasil Dalam Negeri Malaysia Date. All Extras are Included. Muat naik salinan dokumen berikut bersama permohonan.

Borang c tax How To Fill Out Your 2021 Schedule C With Example Tax Form 1095c Tax Form Details Stock Photo 377922721 Shutterstock Irs Schedule C Explained Youtube 2 Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022 2 Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax. C number is corporate tax reporting number to report your company tax commonly handle by your company tax agent. Sistem data praisi akan ditutup pada 22022014.

Lembaga Hasil Dalam Negeri Malaysia. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Lengkapkan borang pendaftaran online.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Borang C and Borang R must be received by the IRB on or before August 14 2003.

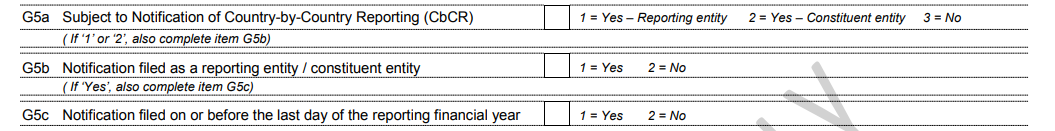

ELAUN JADUAL 3 JADUAL 7A DAN JADUAL 7B C1a Maklumat elaun Jadual 3 Isi HK-E dan ruang C1b Amaun Diserap Baki Hantar Hadapan C1b jika berkenaanJumlah elaun modal dipercepatkan C2 1 Ya 2 Tidak Menuntut elaun bangunan industri di bawah subperenggan 421 Jadual 3. The following are the deadlines for tax filing. LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22.

Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form C. 3 This sample form CANNOT be used for the purpose of submission to Lembaga Hasil Dalam Negeri Malaysia. Every company should have 2 number.

7 months from the close of accounting period 2 This sample form is provided for reference and learning purpose. A statement under section 77A of the Income Tax Act 1967 ITA 1967. 5 Pengemukaan secara e-Filing e-C boleh dibuat melalui httpsmytaxhasilgovmy.

To August 14 2003 for the submission of Borang C and Borang R for year of assessment 2002 in respect of companies whose accounting year ended on December 31 2002. 6 Syarikat boleh dikenakan tindakan di bawah seksyen 112 sekiranya gagal mengemukakan borang nyata pada atau sebelum tarikh. Borang TAHUN TAKSIRAN C 2020 CP5 - Pin.

COMPANY RETURN FORM FOR YEAR OF ASSESSMENT 2020 1 Due date to furnish Form e-C and pay the balance of tax payable. Has submitted Form C for the current year of assessment and for all years assessment. Sales tax exemption under Schedule C is granted to a registered manufacturer for the purchase of raw materials components and packaging packing materials for use in manufacturing of finished taxable goods.

Income Tax Deadlines For Companies Malaysian Taxation 101

Borang C Lhdn 2020 Fill Online Printable Fillable Blank Pdffiller

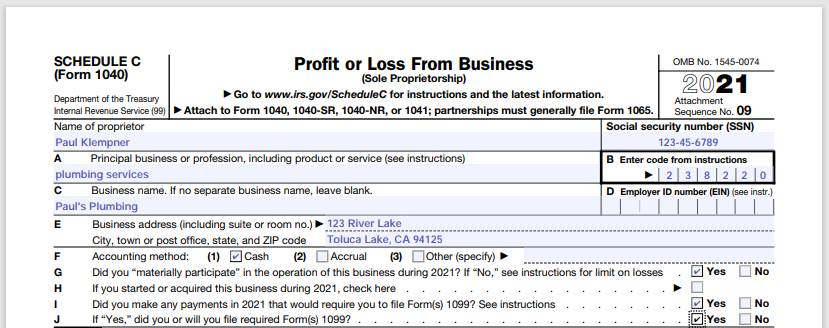

How To Fill Out Your 2021 Schedule C With Example

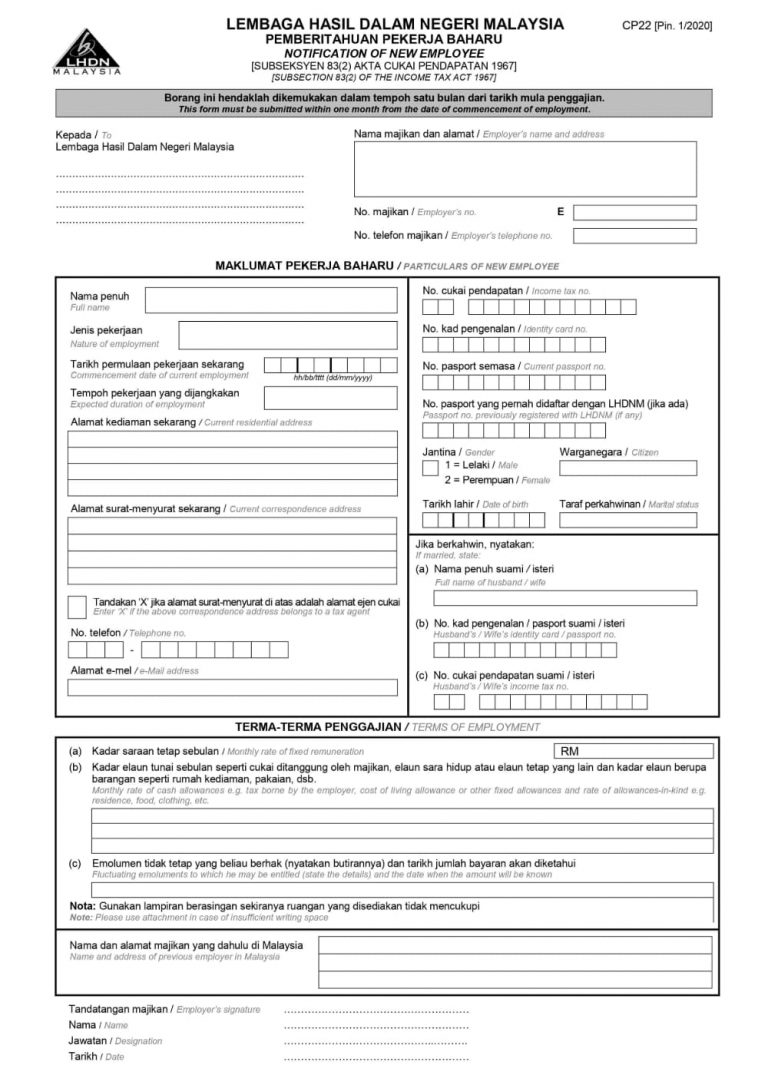

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Filing A Schedule C For An Llc H R Block

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Lembaga Hasil Dalam Negeri Malaysia A A A

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Business Income Tax Malaysia Deadlines For 2021

Form Cp 58 Duty To Furnish Particulars Of Payment Made To An Agent Dealer Or Distributor Etc Malaysian Taxation 101